Financial literacy is a vital life skill, yet many students leave school with little understanding of how to manage money effectively. Concepts like budgeting, saving, credit, debt, and investing often seem abstract and overwhelming in traditional classroom settings.

That’s where financial-themed board games come in, providing an engaging, hands-on approach to learning financial literacy that combines fun with practical knowledge.

Why Financial Literacy Matters for Students

Financial literacy gives students the knowledge and confidence to make informed money decisions throughout their lives. By understanding financial concepts early, students can:

- Learn the importance of budgeting and saving.

- Recognize the consequences of debt and poor money management.

- Strengthen critical thinking skills to handle real-world financial decisions effectively.

- Build habits that support financial independence.

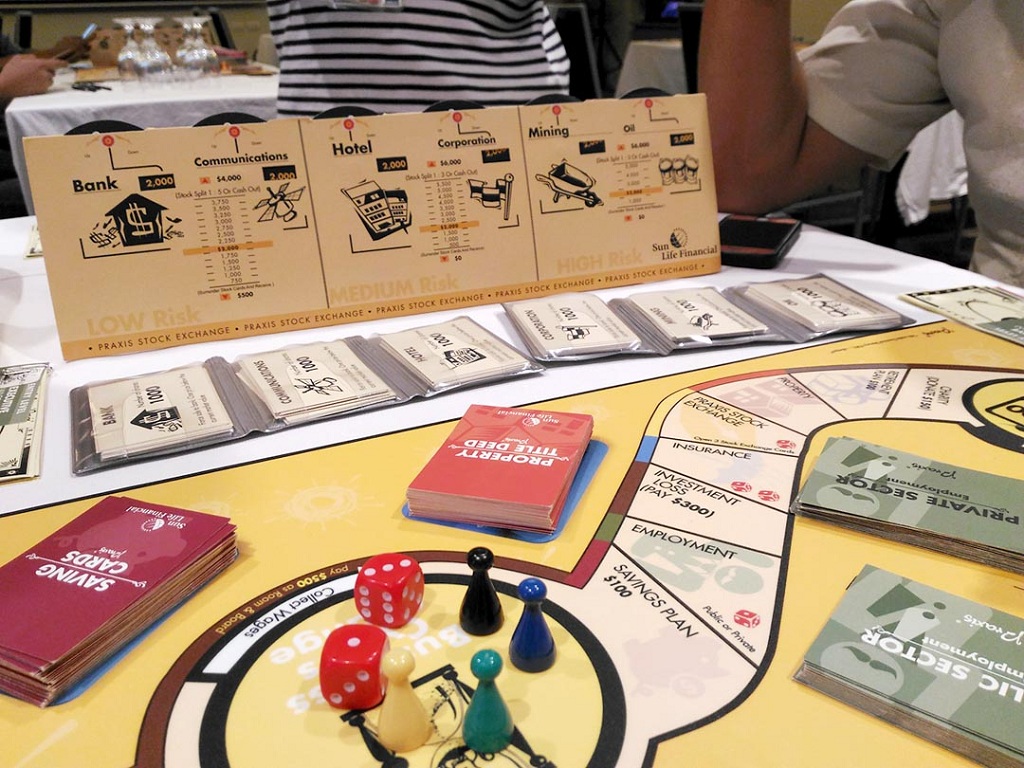

Unfortunately, teaching these skills through textbooks alone often fails to capture students’ interest. Interactive methods, like the custom Monopoly game, bring financial concepts to life in a way students can enjoy and remember.

How Financial Board Games Enhance Learning

Financial board games combine storytelling, strategy, and interactivity with real-world scenarios. This format encourages active participation, making financial topics less intimidating and more accessible. Here’s how custom games benefit financial literacy education:

1. Practical Simulation

Students can “experience” financial decisions – such as buying assets, paying bills, or investing, without real-world risks. Errors turn into valuable lessons rather than expensive setbacks.

2. Engagement Through Play

Games transform learning into a fun experience. Students stay motivated to participate and are more likely to retain lessons from play-based learning.

3. Adaptability

Custom games can be designed for different grade levels, learning goals, and cultural contexts. For younger students, games may focus on simple money recognition and saving, while older students can tackle taxes, loans, and investments.

4. Collaborative Learning

Playing in groups fosters discussion, peer learning, and teamwork. Students share strategies and reflect on financial decisions together.

5. Critical Thinking and Problem-Solving

Financial board games often involve risk assessment, planning, and adapting strategies, skills essential in real-world financial decision-making.

Examples of Financial Literacy Financial Board Game Concepts

Financial board games can be tailored to meet specific teaching objectives. Some potential concepts include:

- Budget Quest – Players manage a monthly allowance, facing random “life events” such as medical bills or car repairs. Success depends on balancing spending and saving.

- Investment Challenge – Students choose between stocks, savings, and real estate opportunities, learning how risk and reward work over time.

- Credit Card Maze – A game where players must use credit wisely, learning about interest rates, debt traps, and the importance of timely repayment.

- Entrepreneurship Builder – Players start small businesses, navigating loans, profits, taxes, and competition while aiming for sustainable growth.

- Financial Freedom Journey – A progression-style game where students work their way toward financial independence by making smart choices about education, work, and money.

Designing Custom Board Games for Classrooms

When creating custom board games for teaching financial literacy, it’s essential to balance fun with educational value. Here are a few design considerations:

- Clear Learning Objectives – Decide what financial concepts the game should teach (e.g., budgeting, saving, debt management).

- Age-Appropriate Mechanics – Simplify money math for younger students while introducing more complex mechanics, like compound interest, for older learners.

- Relatable Scenarios – Incorporate situations students may encounter in their own lives, such as earning allowance, buying school supplies, or saving for college.

- Replay Value – Design multiple strategies and outcomes so students can learn new lessons each time they play.

- Teacher-Friendly Tools – Include clear instructions, discussion prompts, and scoring systems to help educators integrate the game into lessons.

Long-Term Impact of Game-Based Financial Education

By integrating custom board games into financial education, schools can provide students with memorable, practical knowledge that sticks with them beyond the classroom. Instead of passively hearing about money management, students actively practice it in an engaging and safe environment.

Over time, these lessons can translate into real-world confidence, helping students make smart decisions about credit, savings, investments, and entrepreneurship as they enter adulthood.

Conclusion

Financial literacy is too important to leave to chance, and traditional teaching methods often fall short in sparking lasting understanding. Custom board games offer an innovative and enjoyable way to teach money management skills, ensuring students are better prepared for financial challenges in the future. By turning complex financial lessons into interactive experiences, educators can inspire students to take control of their financial futures—one game at a time.